Amazon’s Latest Quarter: AWS Regains Supremacy + SearchGPT, Brick & Mortar Sales

Back again for another quarter from the toll booth of eCommerce: Amazon. A couple of takeaways from last night’s quarterly report:

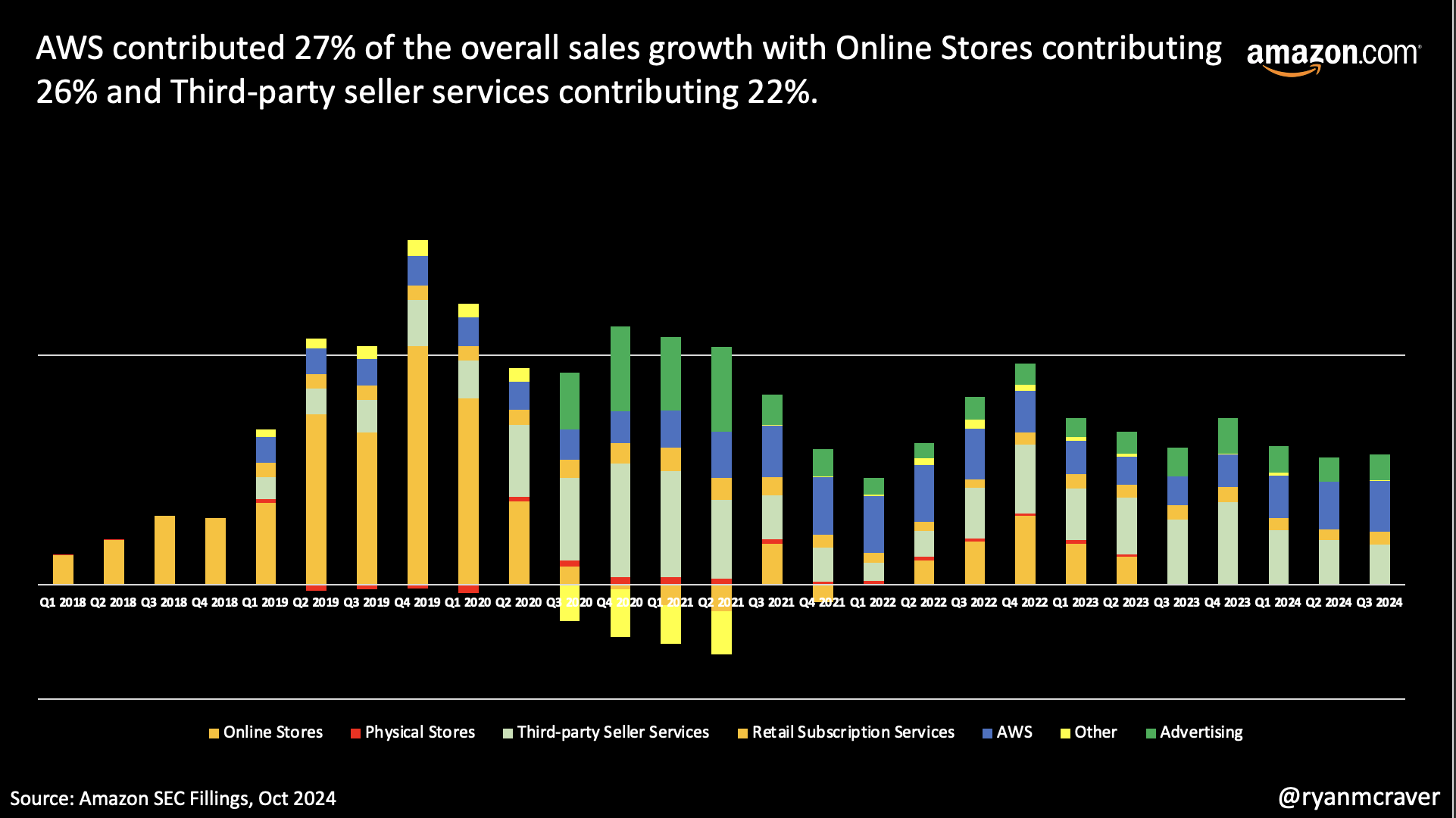

Total revenue growth of 11% growth in revenue which was slightly faster than Q2. While growth accelerated a bit in online store sales, advertising and revenue from 3rd party sellers slowed. Amazon Web Services remains the bread winner in terms of revenue growth and profitability.

2. Historically, Third-party Seller Services have accounted for 28-35% of the sales growth in prior quarters. This quarter slowed and only accounted for 22% of the sales growth. We believe this is an indication of Amazon realizing marketplace fee increases to merchants selling on their site are nearly peaking. The focus by Amazon to earn more of the supply chain via their AWD program and lowering fees to compete against Temu and Shein is evidence of this belief.

3. Advertising continues to slow on the larger base. Whilst cost per click was considerably higher year over year, Amazon will keep focusing efforts to gain advertisers budget at the top of the funnel for awareness advertising. The major growth for bottom of funnel will continue to grow but at a much slower rate.

Bottom Line: Whilst there was some growth in online and brick and mortar for Amazon (Jassy statements from April), AWS has clearly returned as the focus area for growth. Specific to Sellers, we believe the pain of lower profitability and higher cost per click is making its’ way into the reduced advertising and NOW in 3rd party seller fees. We continue to reiterate the need to run Amazon using a hybrid model of 1P Vendor Central and 3P Seller Central to ensure flexibility and profitability.

Other Points To Note:

Change in search is gradually, then suddenly. Perplexity is launching advertising, Reddit explodes, SearchGPT is publicly released and ChatGPT integration with Siri is here. What does all of this mean? Traditional search (mainly Google) is estimated to decline 25% by 2026 and 50% by 2028.

Brick and Mortar is back. General merch, clothing stores and even department stores are posting some of their best numbers in years.

Enjoy the weekend,

Ryan